Concept 23: Market Structures

Overview: All markets are not created equal. The market for candy does not look the same as the market for electricity. This lesson helps you understand different market structures and why they matter.

Learn

Beginner

A market exists anywhere buyers and sellers are interacting. All markets are not created equal, however. Markets function very differently depending on how many buyers and sellers there are, how unique the product is, the ease of entering the market, and how much control individual sellers have over prices. Using these variables, there are four distinct market structures:

Pure or Perfect Competition: markets where there are many buyers and sellers; all sellers are offering nearly identical products; entry is easy; and individual buyers and sellers have no control over price

Monopolistic Competition: markets where there are still many buyers and sellers, but the products are “differentiated” through quality, features, name-brand or advertising; entry is still easy; and sellers have limited control over price

Oligopolies: markets where there are few sellers selling similar products, giving them significant power over price and quantity in the market; it’s difficult for new sellers to enter due to high startup costs, brand loyalty or other factors

Monopolies: markets where there is literally one seller of a unique good, who has tremendous control over price and quantity in the market; entry is impossible due to patents, government protection or other factors

The first activity in the practice section will help you see how each of the main variables relate to the four market structures.

Intermediate

Here are a few examples to illustrate each type of market structure

Pure or Perfect Competition: Very few of these exist in the real world. Agricultural products (like goods sold at a farmer’s market) are commonly used as an example. Though there may be some differences in the size and shape of the fruits and vegetables, it is not usually enough to justify large price differences. The stock market is another close example, as one share of common stock from a company, say Amazon, is identical to another. The only thing that would make a rational buyer choose one share over another should be price. Individual sellers have very little control over the price and no way to differentiate one share of Amazon from another. Other markets that come close are commodities, banking services and the foreign currency market.

Monopolistic Competition: In the US, at least, most industries fall into this category. Shoes, guitars, video games, ice cream, cosmetics, etc. all have name brands, slight variations, multiple sellers, custom options, and so forth If a seller can convince buyers that their product is “better,” they may be able to command a higher price than the average price in the market. This is only possible through product differentiation.

Oligopolies: In the US, the domestic auto industry is essentially dominated by Ford, GMC and Fiat-Chrysler. While there are loads of imported cars, the domestic industry has very few sellers. Internet service providers are another example of a market where there are very few sellers that dominate and control the market. The operating system on your smartphone is likely either Android or Apple based – representing another oligopoly. Oligopolies are often watched carefully by government regulators to make sure they are not abusing their pricing power to harm consumers.

Monopolies: Examples of monopolies are tricky. In their purest form, monopolies – like pure competition – are quite rare and largely based on how you define the market. In rural areas, for example, there may only be one gas station or hospital within 20 or 30 miles. That gives the business a geographic monopoly. They are not, however, the only gas station or hospital in existence, and they still exist in a broader market. Similarly, you might consider Facebook a monopoly of sorts because it is the only company that runs its platform. Broadening the definition a little, however, Facebook exists in a social media market where it competes for attention with other similar sites, like Twitter. Patents, especially on prescription drugs, create short term monopolies of certain products because companies have permission to be the sole producer for a period of time (usually to recoup some of their research and development costs).

Advanced

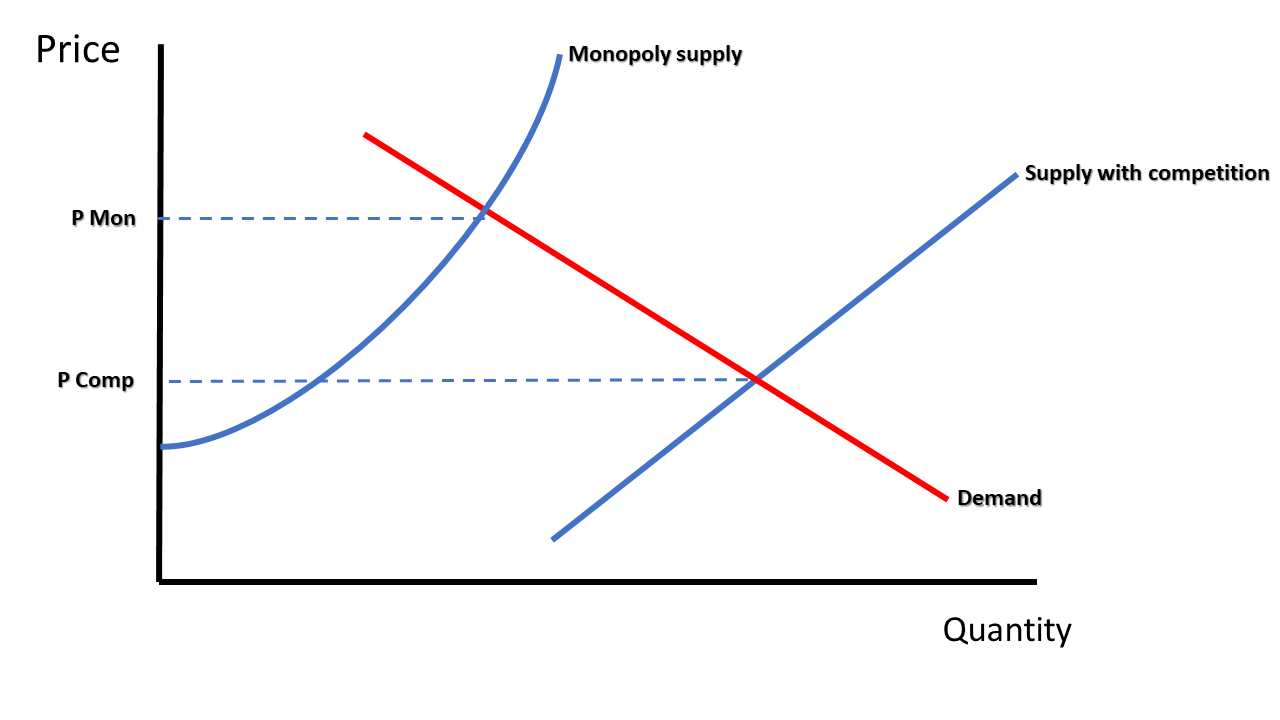

Think about what it would mean to graph the two extremes – pure competition and monopoly – on a supply and demand model. Many people falsely assume that monopolies can charge whatever price they want because they control the quantity supplied. This is not true in most cases, however, because the monopoly would still face a downward sloping demand curve. Consumers may need insulin, but most are not willing and ABLE to pay $10,000 a vial for it.

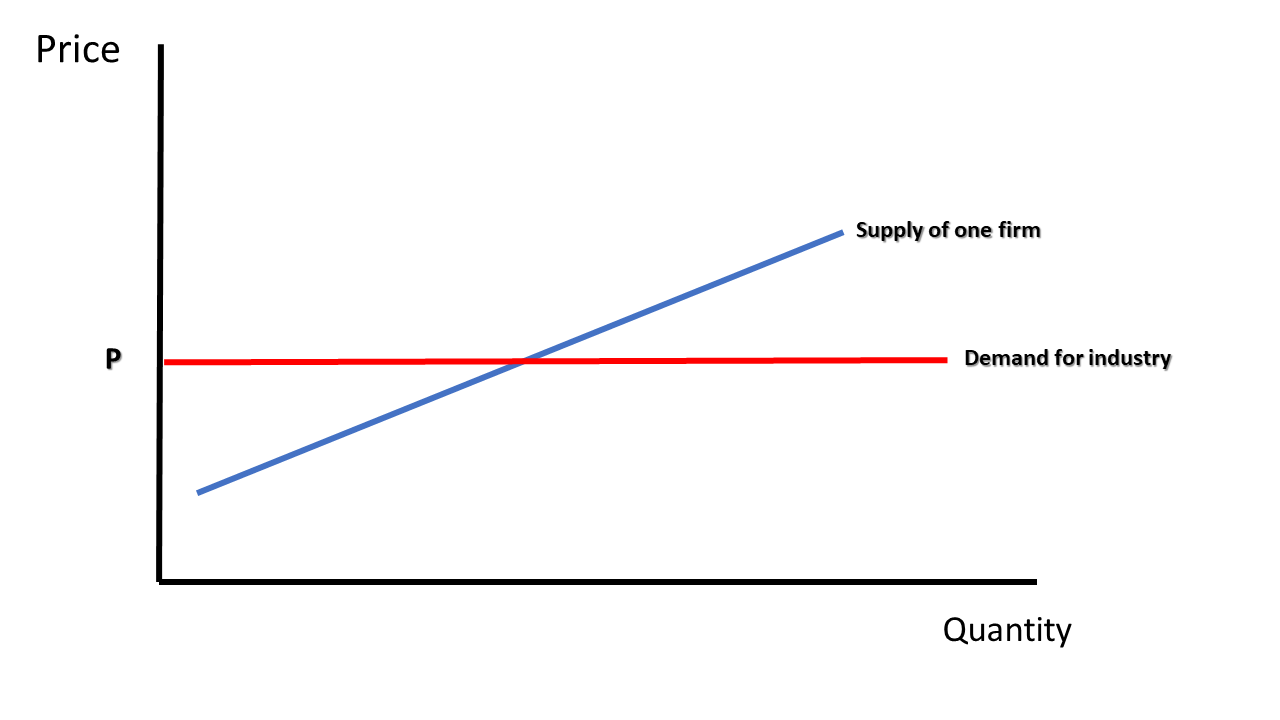

A firm in a perfectly competitive market has a very different problem, however. The market demand is downward sloping, but since the firm’s product is identical to all the others, the demand curve for that firm’s product is actually perfectly elastic at the market price, meaning consumers will quickly switch to a substitute if the price rises.

Finally, as an interesting note of trivia, there are two other market structures where the number of buyers is limited. An oligopsony has only a few buyers (like the worldwide market for commercial cocoa). A monopsony is a market where there is only a single buyer. The US Government, for example, is the sole buyer of the material it uses for “paper” currency.

Click a reading level below or scroll down to practice this concept.

Practice

Assess

Below are five questions about this concept. Choose the one best answer for each question and be sure to read the feedback given. Click “next question” to move on when ready.

Social Studies 2024

Identify the basic characteristics of monopoly, oligopoly, monopolistic competition, and pure (perfect) competition with regards to number of sellers, barriers to entry, price control, and product differentiation.