Concept 46: Taxation and Individuals

Overview: Not all taxes are created equal. Furthermore, not all taxes affect people the same way. This lesson explains different taxes and how they impact people in different ways.

Learn

Beginner

In Concept 34 – Fiscal Policy we described taxes as a tool the Federal Government can use to achieve certain economic goals. Taxes are any government’s primary source of revenue, and changes in tax rates have far-reaching consequences for individuals. In the U.S., taxes are levied at the federal, state and local levels. Taxes paid by individuals include sales, property and income tax.

Sales tax refers to a consumption tax levied on people when they make purchases, such as eating out at a restaurant or buying a pair of shoes. A sales tax is added as a percentage fee added at the point of sale and paid to the government by the retailer. Property tax refers to a tax on real estate and cars people own. Income tax refers to money individuals pay to the federal government (and to some state and local governments) based on income received. When the government increases taxes, individuals have less of their income to save and spend, but the government has more to spend. When government decreases taxes, individuals have more income to save and spend, and the government has less.

Intermediate

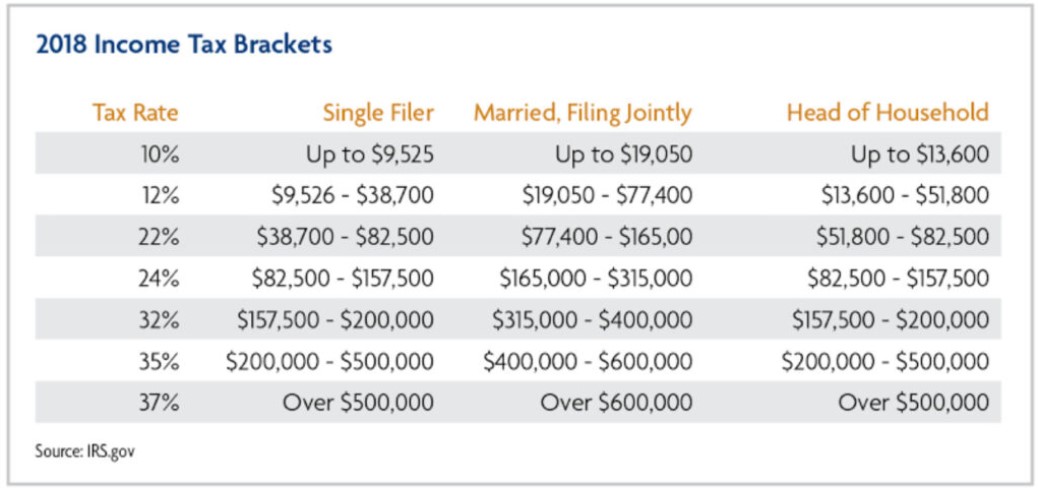

Taxes can fall into three categories: progressive, regressive and proportional, based on how the tax operates. These definitions are all related to income. A progressive (income) tax increases in rate as income increases, meaning higher income earners pay a higher percentage of their earnings than lower income earners. The U.S. federal income tax is a progressive tax. It is important to understand that progressive taxes are usually “marginal” which means you only pay the higher rate on a portion of your income. This is why you year people refer to moving into different tax “brackets.” Image 46-1, for example shows the 2021 tax brackets for the United States. In it, you can see that in the table below, single filers are taxed 10% on dollars $1-$9,525 and 12% on dollars $9,526-$38,700, etc.

A regressive (income) tax rate would decrease as a percentage of income as income increases. Note the use of the word “rate.” For example, a regressive tax could be created where anyone who earns less than $100,000 a year pays 10% in taxes. Anyone who earns more than $100,000 pays 9%. Someone earning $250,000 in this scenario would pay $22,500 in taxes. Someone earning $50,000 would pay $5,000 in taxes. The person earning more money is paying MORE in taxes, but a lower rate and a lower percentage of their overall income.

A proportional (income) tax, also known as a flat tax, does not change as a percentage with respect to changes in income. In the example above, it would be like saying everyone pays 10% regardless of income level. The FICA tax workers pay to fund Social Security and Medicare is proportional. Everyone pays the same percentage of their income to this tax, at least up to a specified income (approximately $135,000). Again, higher income earners would pay a higher dollar amount.

No one tax is “better” than another, and all achieve slightly different goals. All the examples given here are income-tax related but these categories can also be used to describe other kinds of taxes.

Advanced

Sales taxes can get confusing. On the surface, they appear to be proportional. A 5% sales tax means everyone pays 5%, and that’s proportional, right? In reality, sales taxes function much more like regressive taxes because lower income people tend to spend a greater proportion of their income on sales-taxed items than higher income people. Assume two families both spend $500 on a new laptop computer. If the sales tax is 5% then both families paid $25 in sales tax. Now assume family A makes a net income of $2,500 a month and family B makes a net income of $5,000 a month. That $25 in sales tax is 1% of Family A’s monthly income – just on that one purchase! For family B, the same amount is only half a percent of their monthly income. Imagine if local authorities were to raise that tax. Family A will feel that increase more than family B, as regressive taxes place a higher tax burden on lower income earners.

Click a reading level below or scroll down to practice this concept.

Practice

Assess

Below are five questions about this concept. Choose the one best answer for each question and be sure to read the feedback given. Click “next question” to move on when ready.

Social Studies 2024

Describe income, sales, property, capital gains, and estate taxes in the U.S.

Describe the difference between progressive, regressive, and proportional taxes.