Concept 41: Foreign Exchange Markets

Overview: In this lesson you will learn how currencies are really no different than most goods and services when it comes to how they respond to supply and demand.

Learn

Beginner

As explained in Concept 40: Exchange Rates, each country uses its own currency to pay for goods, services and resources. In order to trade with other countries, a process for exchanging currencies is needed. Currency is exchanged via a foreign exchange market, sometimes called a forex market. It is important to understand that the currency market is not one specific location, but rather a network of banks and online institutions that allow money from any country to be exchanged for money from any other country.

Like any other market, there are buyers and sellers in the forex market. It may help to think of the foreign exchange market as a giant table of cash from all over the world. When you want to buy something from another country, you must first purchase their money from the giant table. In this analogy, you would pay for the currency you want with U.S. dollars, just the same way you would pay for milk or shoes or any other good. Your U.S. dollars are now on the table for someone else to purchase if they need to buy goods from the US. You -- as a consumer in the U.S. -- supply your dollars to the foreign exchange market as you demand a foreign currency. The process repeats millions of times a day with currencies from all over the world. This is how exchange rates are set, by supply and demand.

Intermediate

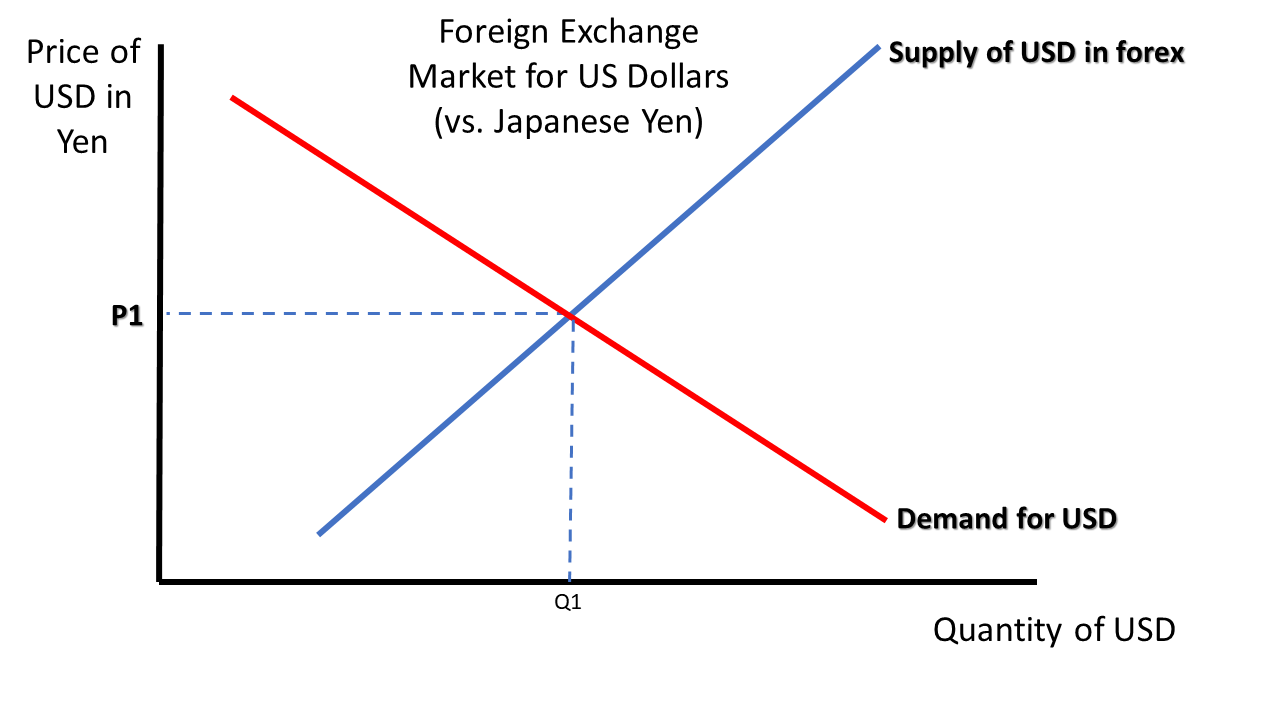

The foreign exchange market is similar to a product market in that it is controlled largely by the laws of supply and demand. Just like a product market, changes in the demand or supply for a particular currency affect the “price” of that currency and the quantity of that currency traded on the market. Graph 41-1 shows a foreign exchange market for the US dollar. Notice that the Y-axis is still price and the X-axis is still quantity. What is slightly different is the “price” in this case is the price of the US dollar in terms of another currency (yen in this case). Price P1 is the current exchange rate or, the number of yen it would take to purchase a dollar.

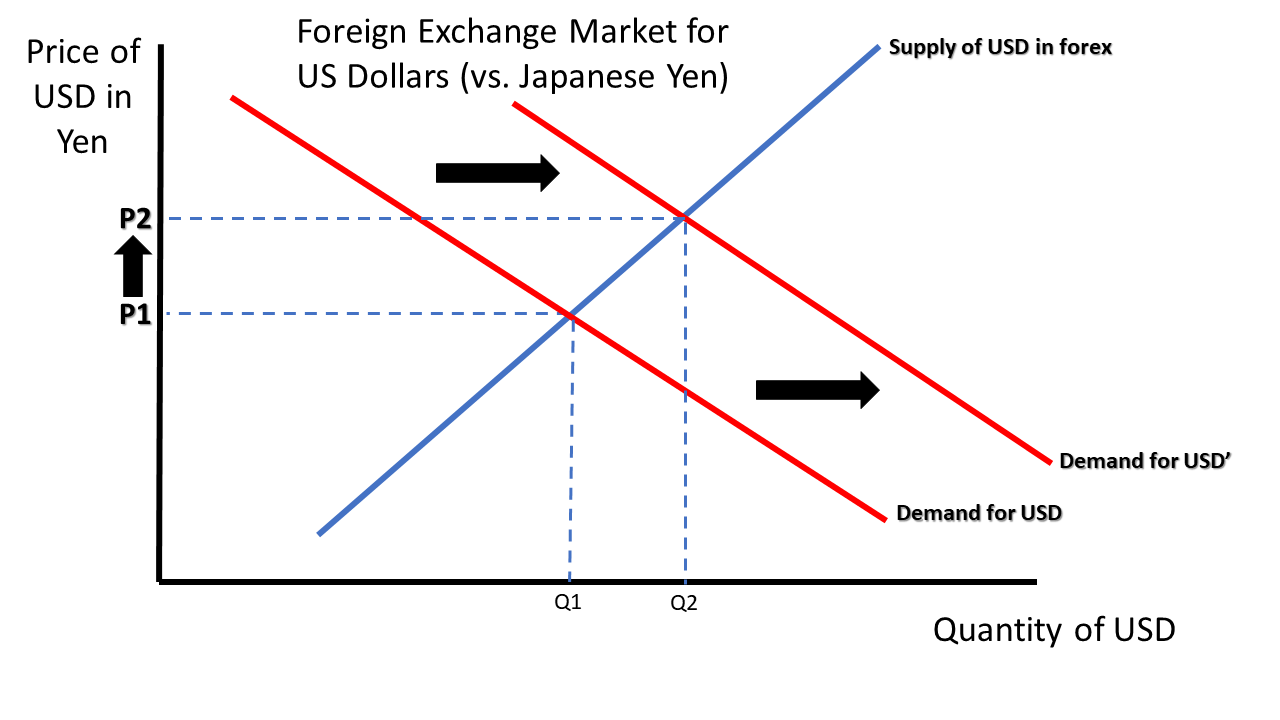

Assume that Japanese businesses decide they want to import more US products or there is a large influx of Japanese tourists who want to visit the United States. In either scenario, there would be increased demand for US dollars from people in Japan. Graph 41-2 shows what happens if the demand for US dollars increases. The price, or exchange rate, increases, and it now takes more yen to purchase a US dollar.

Supply and demand for foreign currencies do have slightly different determinants compared to other markets. In general, supply and demand for foreign currencies is influenced by international travel, investment opportunities from abroad, desire to import/export, relative interest rates, relative prices, and foreign political decisions and stability.

Advanced

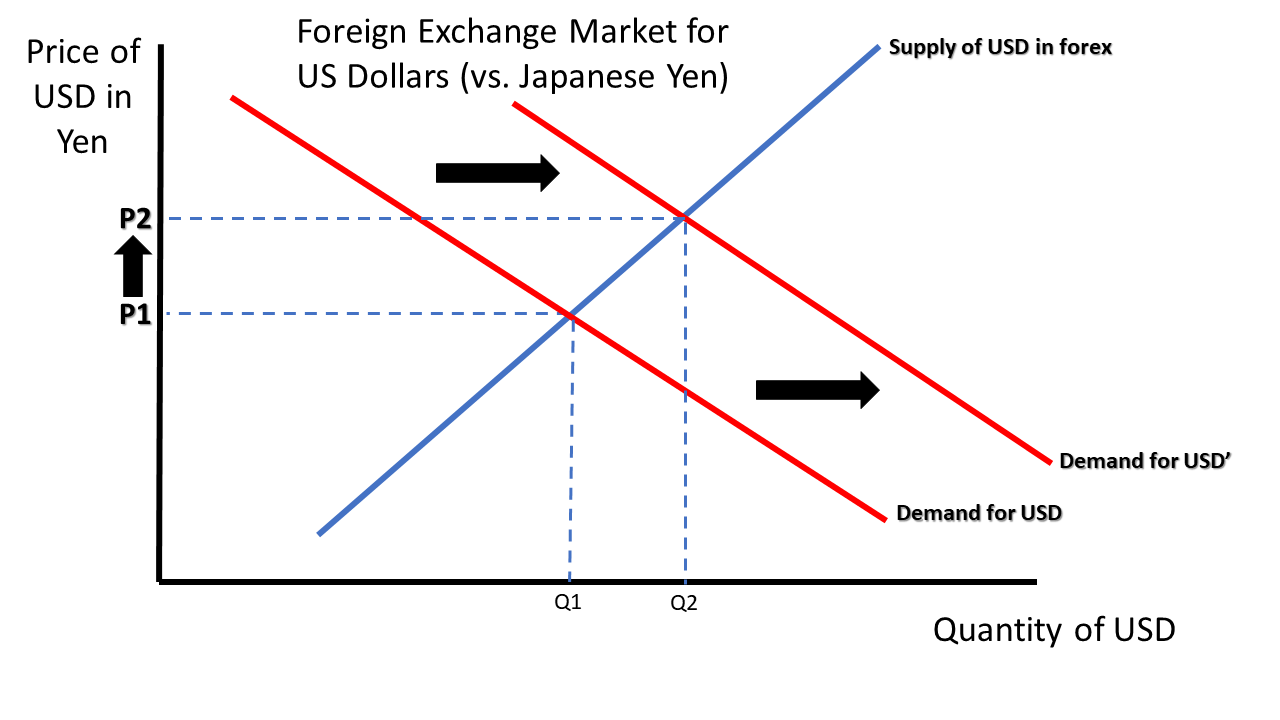

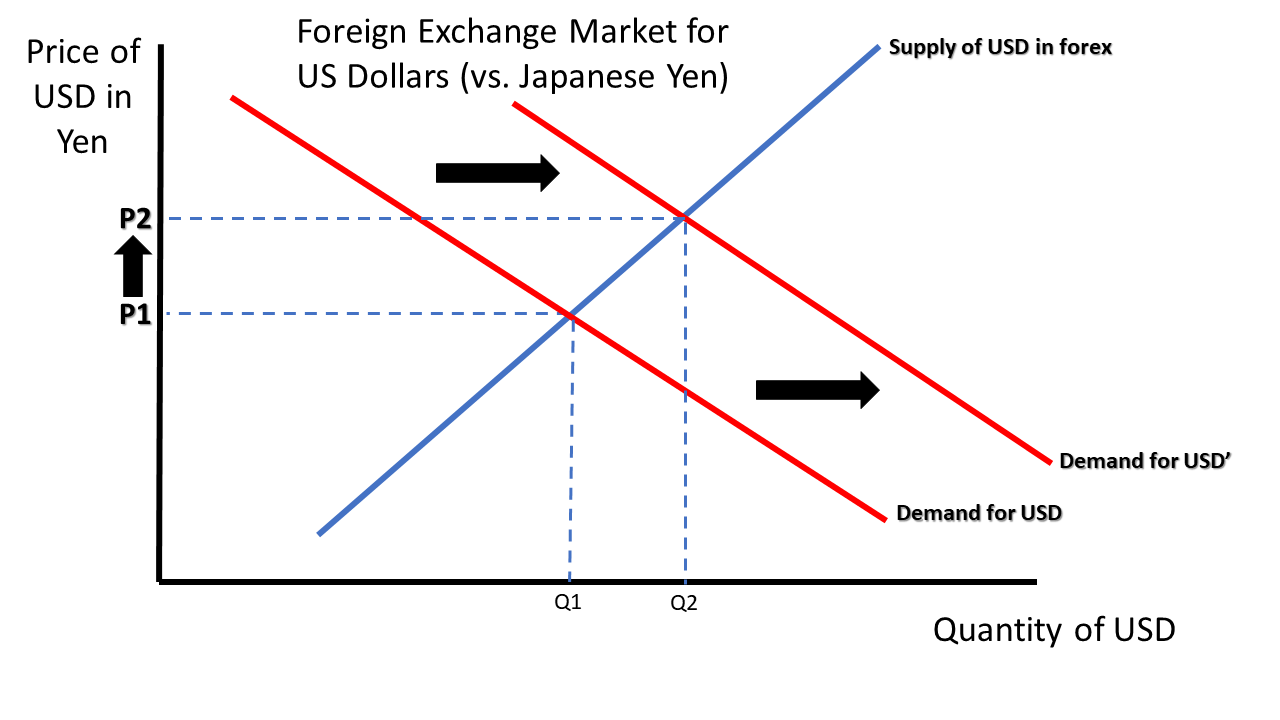

An interesting phenomenon can be seen when graphing exchange markets that is unique to currency exchanges. Remember from Graph 41-2 that the demand for US dollars increased, causing the price of US dollars to increase in terms of Japanese yen. Intuitively, that must mean that more Japanese yen was brought to the “table” we referenced in the beginner reading. You can see this on Graph 41-3 as an increase in the supply of Japanese yen to the market, resulting in the yen depreciating against the US dollar. Graphs 41-2 and 41-3 occur at the same time as the currencies move against each other. Any time one currency appreciates against another, the other currency depreciates at the same time.

Click a reading level below or scroll down to practice this concept.

Practice

Assess

Below are five questions about this concept. Choose the one best answer for each question and be sure to read the feedback given. Click “next question” to move on when ready.

Social Studies 2024

Explain how appreciation and depreciation of currency affects net exports and benefits some groups and hurts others.