Section Branding

Header Content

FTC sues to block big semiconductor chip industry merger between Nvidia and Arm

Primary Content

The Federal Trade Commission on Thursday sued to block a $40 billion deal in which the Silicon Valley chip maker Nvidia sought to buy British chip designer Arm.

Officials with the FTC say the deal, which would be the largest semiconductor-chip merger in history, would give Nvidia unlawful power, hurt competition and raise prices for consumers.

"Tomorrow's technologies depend on preserving today's competitive, cutting-edge chip markets," said Holly Vedova, who leads the FTC's competition bureau. "This proposed deal would distort Arm's incentives in chip markets and allow the combined firm to unfairly undermine Nvidia's rivals."

The lawsuit comes after months of scrutiny from regulators in both Washington and Europe.

A spokesman for Nvidia said it will fight the FTC's suit and that the company "will continue to work to demonstrate that this transaction will benefit the industry and promote competition."

It is the latest action taken by an FTC headed by Biden appointee Lina Khan, a fierce critic of how major tech companies wield their power who has vowed to rein in corporate merger activity that stifles competition and could affect consumer prices.

"Lina Khan has been very clear that she wants to reduce corporate concentration in economically important sectors, and these are two very big companies whose markets are converging," said Steven Weber, a professor at the School of Information at the University of California, Berkeley, in an email.

"So on the surface, it's a fight simply against the big getting bigger," he said.

Weber said Nvidia has become a leading chip maker for technology that relies on machine learning and artificial intelligence. Arm designs the blueprints for high-performance chips that power smartphones and other gadgets.

"Put those two together, and you can see the potential for market power that could make it harder for competitors to get access to the very latest basic infrastructure technologies to build AI products," Weber said.

Nvidia, which last year overtook Intel as the most valuable chipmaker in the U.S., supplies chips for things like graphics-heavy video games, cloud computing and cryptocurrency mining.

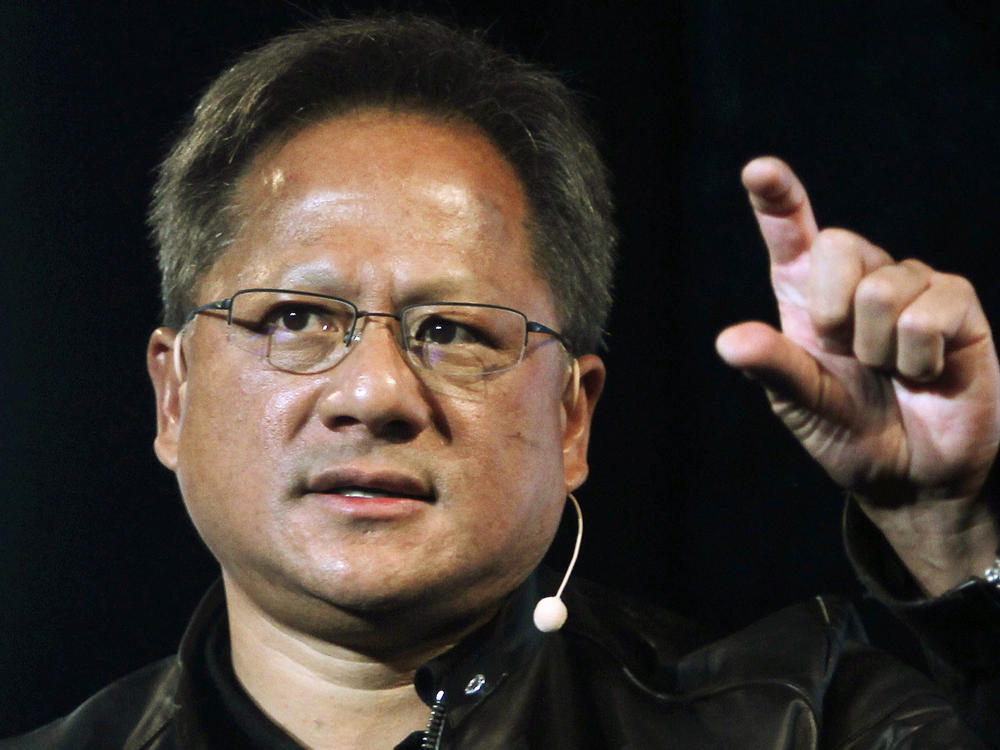

Nvidia CEO Jensen Huang saw the deal when it was announced, in September 2020, as a way to expand the company's footprint beyond its core customers. Huang said the acquisition would "create the premier computing company for the age of artificial intelligence."

Huang also promised to not meddle with Arm's business model. It is seen as the "Switzerland" of the chip industry since it provides chip designs to hundreds of companies, including Big Tech companies Apple and Amazon, but does not compete with any of them.

Soon after the deal was announced, however, fresh attention from regulators ensued. So did concern from tech giants including Alphabet, Qualcomm and Microsoft, which said the merger would give Nvidia too much power over Arm. Tech firms were also worried it would allow Nvidia to access sensitive information about its competitors, something the FTC echoed in its complaint.

"Arm licensees share their competitively sensitive information with Arm because Arm is a neutral partner, not a rival chipmaker," the FTC wrote in its filing in administrative court. "The acquisition is likely to result in a critical loss of trust in Arm and its ecosystem."

The lawsuit from regulators comes as a global shortage of chips wreaks havoc on supply chains, including those of major automakers like GM. It has been forced to shut down some assembly lines through March. In response, the U.S., and countries around the world, have committed to major investments to accelerate the production of domestic chip production.

Copyright 2021 NPR. To see more, visit https://www.npr.org.