Section Branding

Header Content

They were Sam Bankman-Fried's friends. Now they could send him to prison for life

Primary Content

Less than a year ago, Sam Bankman-Fried and three of his closest associates in his former crypto empire were living a charmed life in The Bahamas.

But one by one, they have turned against Bankman-Fried, leaving their friend and former boss all alone.

They worked side by side, helping Bankman-Fried grow the cryptocurrency exchange FTX and an investment firm called Alameda Research into multibillion-dollar businesses before both companies collapsed last year in a spectacular fashion.

Now, Bankman-Fried is being charged with several criminal counts, including fraud, and his fate could hinge on the testimony provided by three of his now-former lieutenants. If convicted of all charges, the former FTX CEO could spend the rest of his life in prison.

Each former executive — Caroline Ellison, Gary Wang, and Nishad Singh — has shared damning details about what prosecutors have said was a sprawling fraud orchestrated by Bankman-Fried.

His three associates have unique insights into him and his businesses: They were colleagues, but they were also close friends.

They worked together on an island in The Bahamas, and most of them lived together in a $30 million penthouse.

Bankman-Fried and his former colleagues worked and socialized together: When they weren't writing code or tweaking trading strategies, they shared meals and played paddle tennis.

They have now each pled guilty to helping Bankman-Fried defraud customers, while enriching themselves, and they are cooperating with prosecutors as they hope to get less — or no — time in prison.

Here's a look at the trio of former executives who have turned against Bankman-Fried:

Caroline Ellison

She was always going to be the star witness in Bankman-Fried's trial.

Now 28, Ellison met Bankman-Fried at a Wall Street firm. He was an MIT graduate, and she was finishing up her undergraduate degree at Stanford University, where she was a math major.

Two years later, in 2018, Bankman-Fried convinced her to join a fledgling, cryptocurrency-focused investment firm he started, Alameda Research, which is now central to the U.S. government's case against him.

Prosecutors allege Bankman-Fried steered FTX customer money to Alameda Research, to make up for multibillion-dollar losses, and to make risky investments in start-up companies.

Ellison's relationship with Bankman-Fried wasn't strictly professional.

In 2018, the two of them began dating, and that power dynamic became especially difficult when Bankman-Fried promoted her to CEO of Alameda Research, she said.

"I would say in our personal relationship there was a general theme that I sort of wanted more from our relationship, but often felt like he was distant," Ellison recalled.

More than any other witness, Ellison provided insight into Bankman-Fried as a person and a boss — and she didn't equivocate.

Bankman-Fried "directed me to commit these crimes," she told the court. She also said Bankman-Fried instructed her to send "dishonest" financial information to lenders and investors.

But Bankman-Fried's defense team has suggested Ellison is responsible for mismanaging Alameda Research's finances, and tried to portray her as an incompetent and inexperienced leader who failed to prepare for a downturn in the cryptocurrency market in 2022 that led to substantial losses.

Having pled guilty to seven criminal charges, Ellison faces 110 years in prison.

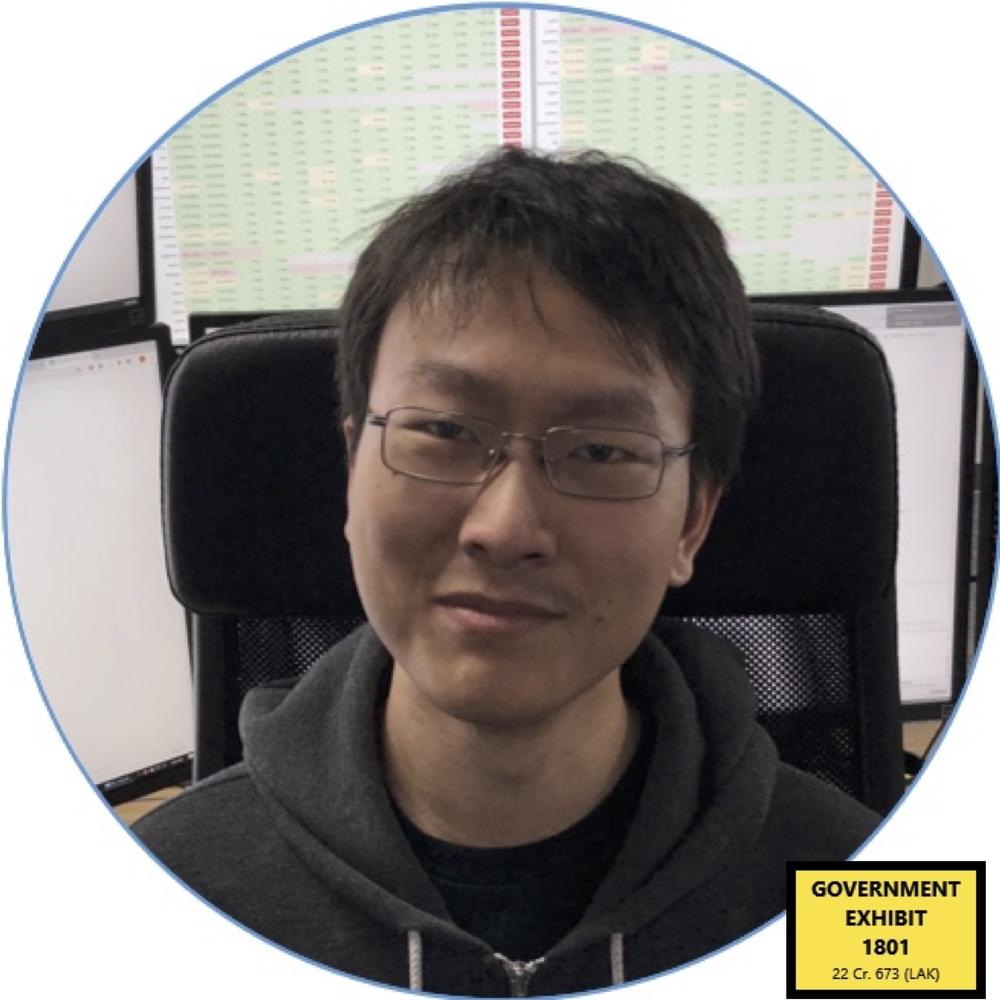

Gary Wang

Bankman-Fried and Wang met in 2010, when they both attended a five-week, math-focused summer camp at Mount Holyoke College in Massachusetts.

Later, the two of them reunited at MIT, where Wang majored in math and computer science, while Bankman-Fried studied physics.

They were both members of the fraternity Epsilon Theta, and in 2017, Bankman-Fried traveled back to the Boston area, where Wang was working for Google, to suggest the two of them start their own trading firm.

Wang was instrumental in building both Alameda Research and FTX. He owned 10% of Alameda Research, and 17% of FTX.

In his testimony, Wang said his job was to translate Bankman-Fried's vision into computer code.

He testified that, with some simple tweaks to computer code, Wang and his colleagues made it possible for Alameda Research to take as much as $65 billion from FTX customers without them knowing, admitting they had "lied about this to the public."

Wang pleaded guilty to four criminal counts. He faces 50 years in prison.

Nishad Singh

Bankman-Fried first crossed paths with Singh at Crystal Springs Uplands School, a prestigious private school they both attended in Northern California.

Singh, who is 27, was close with Gabe Bankman-Fried, Sam Bankman-Fried's younger brother.

After Singh graduated from the University of California, Berkeley, where he studied computer science, he briefly worked at Facebook. Then, Bankman-Fried recruited him to Alameda Research in 2017.

Singh eventually became FTX's chief engineer. He told the court that at Bankman-Fried's direction, he wrote the computer code that effectively allowed Alameda to borrow — or take — from FTX tens of billions of dollars.

"I defrauded customers, investors," Singh said. "I participated in money laundering, and I violated campaign finance laws."

On the witness stand, he described how he lost faith in Bankman-Fried, and Singh testified there were numerous times during his tenure when he considered resigning. But he never went through with it because he thought his departure could raise eyebrows and imperil the company.

Singh said that, when FTX and Alameda collapsed, he was suicidal.

"I had a lot of admiration and respect for him," Nishad Singh said, of Bankman-Fried. "Over time, I think a lot of that eroded, and I grew distrustful."

Singh has pled guilty to five charges. He faces 75 years in prison.

Copyright 2023 NPR. To see more, visit https://www.npr.org.