Section Branding

Header Content

Here are 3 reasons why stocks are tanking

Primary Content

Stocks sank on Friday, ending what has been a miserable month for markets, especially for Big Tech.

The Dow Jones Industrial Average lost nearly 1,000 points, while the S&P 500 lost more than 3%, with both indexes posting hefty losses for April.

But it was a lot worse for the tech-heavy Nasdaq, which sank more than 4% on Friday and ended down more than 10% for April, its worst month since 2008.

The deep declines reflect a time of deep uncertainty at a moment when the economic landscape is changing rapidly.

Here are the top three things sinking Wall Street.

Big Tech is going from winner to loser

The pandemic was good for Big Tech earnings.

Buoyed by low interest rates and the sudden pivot to quarantines and remote work, companies from Netflix to Zoom had some banner months in terms of profits.

And what is good for Big Tech is generally good for markets given that information technology companies account for 28 percent of the S&P 500.

But things have changed — and swiftly.

The world is learning to live with COVID. Workers are returning to their offices. Demand for travel is booming. And restaurants are filling up again.

That means Big Tech is now competing with other demands on peoples' time.

Netflix shocked Wall Street last week after announcing it lost subscribers in the first three months of the year, the first time that's happened in more than a decade. The announcement sent shares down by more than 40%.

Other Big Tech companies have also reported disappointing earnings or outlooks, with a few exceptions, such as Meta, the parent company of Facebook.

Amazon on Thursday posted its first quarterly loss since 2015, partly because people returned to shopping in physical stores, marking a sharp contrast to the pandemic when profits at the online retailer boomed.

Meanwhile, Apple posted very strong results, but its share price fell after it warned that COVID-19 lockdowns in China could impact supply chains, and hence sales.

The Fed is fighting inflation — and it could get rough

It's not just Big Tech earnings though.

The market has already been under pressure as the U.S. deals with its highest inflation levels in about 40 years.

Those surging prices have proven to be a persistent, pernicious problem for the U.S. and global economies.

But investors aren't just worried about inflation itself, which is at a 40-year high, they are also unsure about whether the Federal Reserve will be successful fighting it.

At the Fed's last meeting, the central bank decided to hike interest rates by a quarter of a percentage point, but Fed Chair Powell Jerome Powell and other policy makers have since signaled they are preparing a much more aggressive response.

The Fed is now widely expected to raise interest rates by half a percentage point at its follow-up meeting next week, and markets are bracing for more rate hikes this year.

"I think that the market has wanted the Fed to fight this fight," says Lori Calvasina, the head of U.S. equity strategy at RBC Capital Markets. "But I do think the market is unsettled by the idea of these big, chunky, kind of quick increases."

The Fed has a tricky job to do. The goal is to engineer a so-called soft landing. It's trying to slow down the economy just enough to cool down inflation.

But raising interest rates is never an exact science, and investors fear the Fed will be too aggressive and unintentionally tip the economy into a recession.

To be sure, a recession is still not seen as a likely outcome, but it's widely seen as a potential threat to the economy.

Then there's China and the war in Ukraine

If the prospect of recession wasn't enough, Wall Street is also dealing with a challenging geopolitical environment.

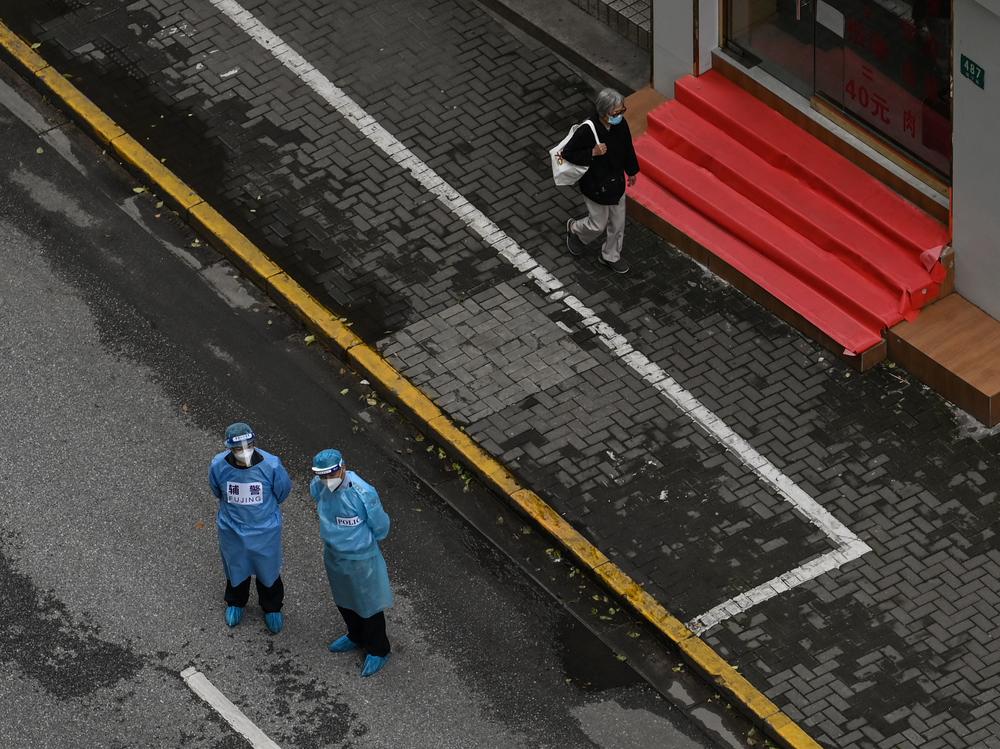

China is implementing stringent rules to fight a spike in COVID-19 cases. Shanghai has been under a lockdown for five weeks now and the government has closed ports and factories in some of the country's largest cities.

The consequences of that crackdown could have ripple effects around the world.

During the pandemic, supply-chain issues proved to be a huge problem, helping to fuel higher prices. Manufacturing slowed, and deliveries were delayed. Now, there is a fear that supply-chain issues could linger longer.

Meanwhile, Russia's invasion of Ukraine continues to impact companies while putting pressure on commodity prices.

Since late February, Brent crude, the international oil benchmark, has traded above $100 a barrel. Previously, it was trading in the $70-to-$80 range.

But it's not just energy prices that have surged. Because of the incursion, and the sanctions and trade restrictions imposed by the U.S. and its allies, prices for grains and metals have also soared.

Apple CEO Tim Cook warned about the global challenges when presenting earnings results this week.

"I want to acknowledge the challenges we are seeing from supply chain disruptions driven by both COVID and silicon shortages to the devastation from the war in Ukraine," he said on the call.

Copyright 2022 NPR. To see more, visit https://www.npr.org.