Section Branding

Header Content

Georgia Senate seeks smaller tax cut, film tax credit limit

Primary Content

Georgia senators have proposed a much more modest income tax cut than the $1.1 billion plan passed by the House, and also want to sharply reduce tax breaks for film and television productions that have been credited with transforming the state into one of the world's biggest filming hubs.

The Senate Finance Committee on Monday voted to make major changes to House Bill 1437, setting up what could be a showdown on a top priority of Republican House Speaker David Ralston of Blue Ridge with a week left in the 2022 regular session. The full Senate could debate the bill as soon as Wednesday, but Senate passage would only set the stage for the main event — negotiations between the Senate and House.

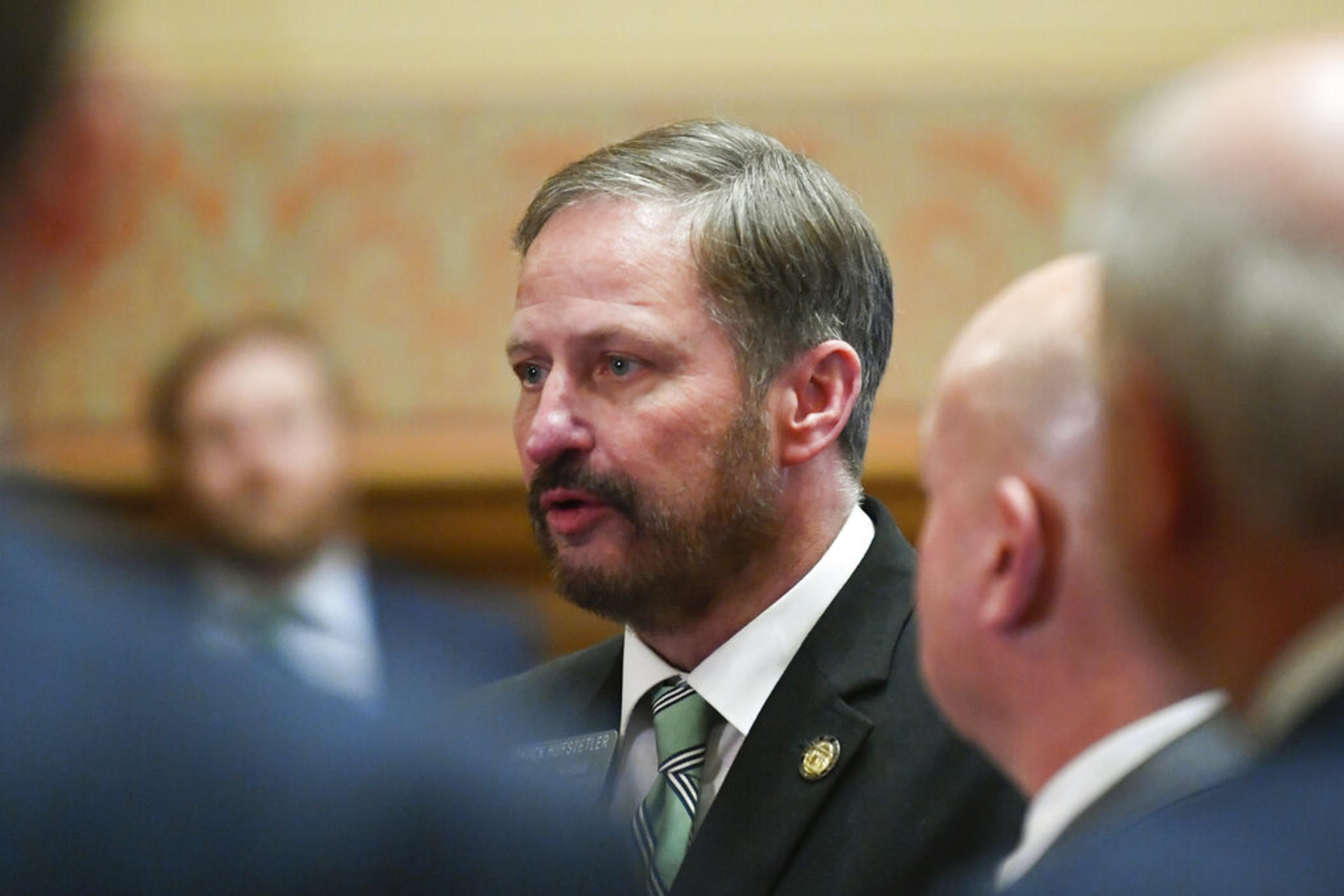

"We obviously know this is going to go back and forth between the House and Senate," said Senate Finance Committee Chairman Chuck Hufstetler, a Rome Republican.

The Senate plan would by 2032 — or maybe later if state tax receipts falter — create a single flat state income tax of 4.99%. That's a lower rate than the 5.25% proposed by the House. But whereas the House would eliminate many deductions, the Senate would keep current deductions.

Hufstetler said the House proposal increases taxes on some people who itemize, while he's aiming for a bill that would lower everyone's taxes. His proposal concentrates earlier years of benefits on people with lower incomes.

"Every single income bracket is getting a tax decrease," Hufstetler said. "I think it's fairer, and I also think it's fairer to help those at the bottom first."

Georgia's top income tax rate is now 5.75%.

Hufstetler's plan would create a flat rate of 4.99% in steps, starting in 2024 with married couples making less than $20,000 a year and single people making less than $13,000 a year. Everyone's top rate would fall slightly to 5.7% in 2024 from the current 5.75%. Most people would notice the changes when they filed their taxes in 2025.

The 4.99% rate would rise up the income ladder in nine steps. But tax cuts would pause any year in which state revenue doesn't grow 3%, any year that revenue is lower than any of the five previous years, or any year the state doesn't have more money in its savings account than the tax cut would cost.

Hufstetler said senators want to avoid "concerns about the budget" that might be caused by a lack of revenue crimping spending.

He said a formal revenue estimate is being prepared but said his package would cost $233 million in its first year, rising to $500 million or more.

The bill also includes an earned income tax credit for low-income earners that would be up to 10% of the federal EITC, or a ceiling of about $675 this year. Unlike the federal credit, someone couldn't get back more than they paid in state taxes.

Blackmon told The Associated Press in an interview after the meeting that he hadn't seen Hufstetler's proposal. He said he favored his approach, although he told senators he's open to negotiations.

"I think it's very simple. It's fair for everybody," Blackmon said. "I do think that no plan is perfect. I would say that we're letting I think lower middle income families keep more of their money."

An analysis by the liberal-leaning Georgia Budget & Policy Institute, using modeling by the Institute on Taxation and Economic Policy, showed 62% of the benefits from the House proposal would go to the top 20% of Georgia tax filers. About 20% of filers making more than $64,000 a year would see tax increases, the GBPI analysis shows.

Hufstetler also would cap the film tax credit at $900 million annually. Championed by Republican governors for more than 15 years, those credits have fueled explosive growth in film and television production in Georgia. The state Office of Planning and Budget estimates the state will forgo $1.07 billion in revenue from the credit this year.

More importantly, Hufstetler would ban film companies from selling the tax credits they can't use to others. Without those transfers, production companies would likely be able to use only a fraction of the credits they accrue. After Dec. 31, transfers would be banned. All outstanding transferred credits would have to be cashed by Dec. 31, which could void much of the $1 billion in outstanding credits.

Hufstetler has long questioned whether Georgia is getting its money's worth out of the tax credit.

"To me, there's big problems with the program, but what we're saying is, in the meantime, let's put a reasonable cap in place on this to keep it from getting out of control," he said.