Section Branding

Header Content

Federal Trade Commission accuses Intuit of deceptively advertising TurboTax as free

Primary Content

The Federal Trade Commission is accusing the company that makes TurboTax of deceptively advertising free tax filing. Many people end up having to pay for the service they believe will be free, the agency says.

In a complaint filed Monday in U.S. District Court in Northern California, the FTC asked the court for a temporary restraining order and a preliminary injunction against Intuit.

"Absent such provisional relief, [Intuit] would be free to continue disseminating the deceptive claim that consumers can file their taxes for free using TurboTax when in truth, in numerous instances [Intuit] does not permit consumers to file their taxes for free using TurboTax," the complaint says.

The FTC complaint notes a situation experienced by many Americans: After spending time and effort plugging all their information into TurboTax, they are told that to file their returns correctly, they need to upgrade to the paid product. "In truth, TurboTax is only free for some users, based on the tax forms they need," the complaint says.

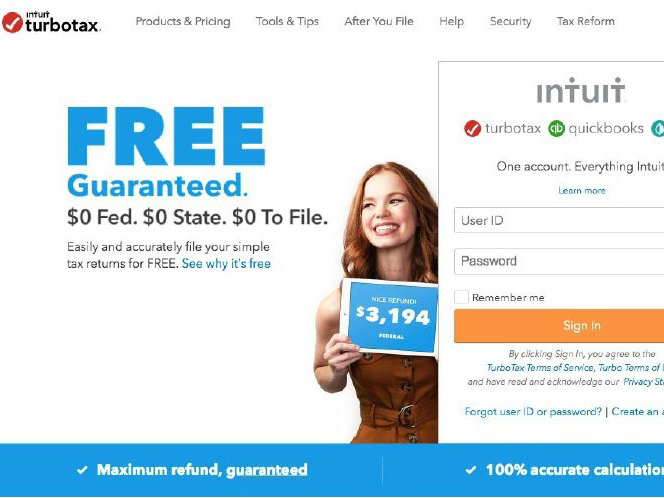

The complaint says that for years, much of Intuit's advertising for TurboTax's online service has emphasized the message that consumers can use TurboTax to file their taxes for free. The FTC points to TV commercials for TurboTax in which the word "free" is said over and over.

At the end of many of Intuit's ads is a disclaimer in smaller print that states such offers are limited to those with "simple" tax returns. But the FTC argues that the disclaimers "are inadequate to cure the misrepresentation that consumers can file their taxes for free using TurboTax," when in many cases they cannot.

The FTC offers the print at the bottom of one ad as an example of such hard-to-read language. The small type says, "Free Edition product only. For simple U.S. returns."

The commission also pointed to marketing that used the words "Free Guaranteed."

Among those ineligible for the "freemium" version of TurboTax are those who receive income reported through certain types of IRS Form 1099, the FTC says — it's commonly used by people who receive independent contractor or small business income, like those working in the gig economy.

Intuit also hasn't allowed its freemium edition to be used by people who have income from a farm, selling a home, a prior year state tax refund or investments, according to the FTC.

At the same time, many of the low- and middle-income people who ended up getting pushed to upgrade to a paid version of TurboTax would have been eligible to file their taxes electronically for free through IRS Free File — a program that Intuit was part of until 2021. The FTC notes that Intuit changed the name of its Free File and freemium products several times, resulting in consumer confusion.

The filing also states that Intuit hid its Free File landing page for about five months during the peak of the 2018 tax season, channeling consumers to its freemium version — which many would end up having to pay for.

In a statement on its blog, Intuit, which also owns Mint, QuickBooks, Credit Karma and Mailchimp, said it would "vigorously challenge" the complaint and that it "continually sought and continues to seek ways to increase the number of taxpayers that file" using its free tax prep products.

"The FTC's arguments are simply not credible. Far from steering taxpayers away from free tax preparation offerings, our free advertising campaigns have led to more Americans filing their taxes for free than ever before and have been central to raising awareness of free tax prep," said Kerry McLean, executive vice president and general counsel of Intuit, in a statement.

Intuit said that the fact that it "complied with the rules and regulations of one government agency, but is now being targeted by another, demonstrates a significant disconnect."

In its complaint, the government cites the reporting of ProPublica, which has been reporting for several years that Intuit has been waging a multi-pronged effort to prevent Americans from filing their taxes for free.

The FTC's complaint isn't the only front Intuit is fighting now.

ProPublica reported last month that while Intuit had managed to knock down a class-action lawsuit and push it into arbitration, a Chicago law firm is "bankrolling customers bringing tens of thousands of arbitration claims against Intuit. Win or lose, this strategy could cost Intuit tens of millions of dollars in legal fees alone — a threat that could prod the company to be more open to a giant settlement."

Editor's note: Intuit is among NPR's financial supporters.

Copyright 2022 NPR. To see more, visit https://www.npr.org.